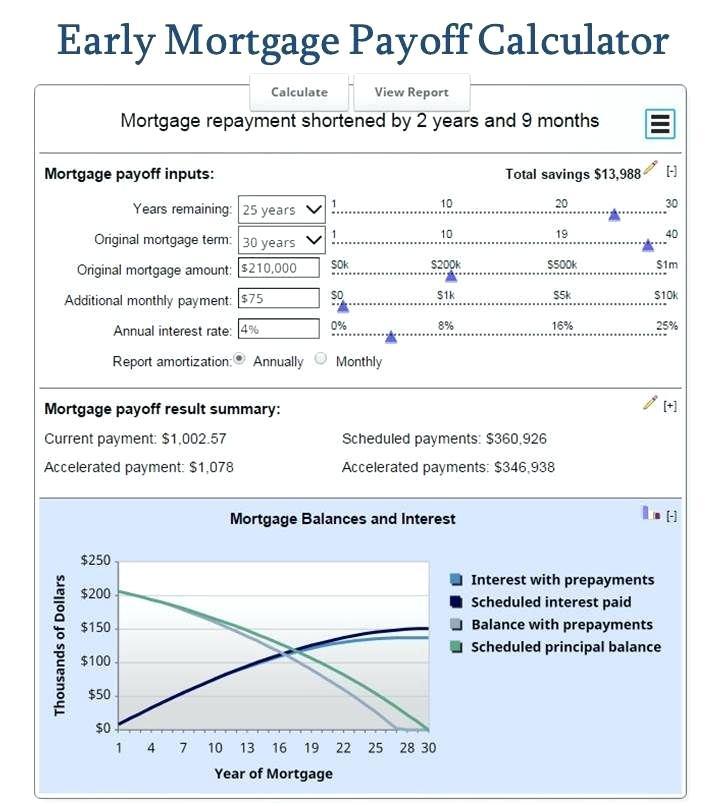

An extra $10,000 will be contributed in the sixth month of your loan term.įrom this information, the calculator shows that your 30-year loan term will reduce by two years and two months, and you’d save a total of $62.438 in interest - a huge amount considering the small outlay. over a 30-year loan term.Īdditional repayments will be made on top of your standard monthly repayment of $100 each month. Let’s say you have an $800,000 home loan with a 4.5% interest rate p.a. To help you understand how extra and lump sum payments can impact the total amount you will need to repay on your home loan, here is an example provided by the calculator.

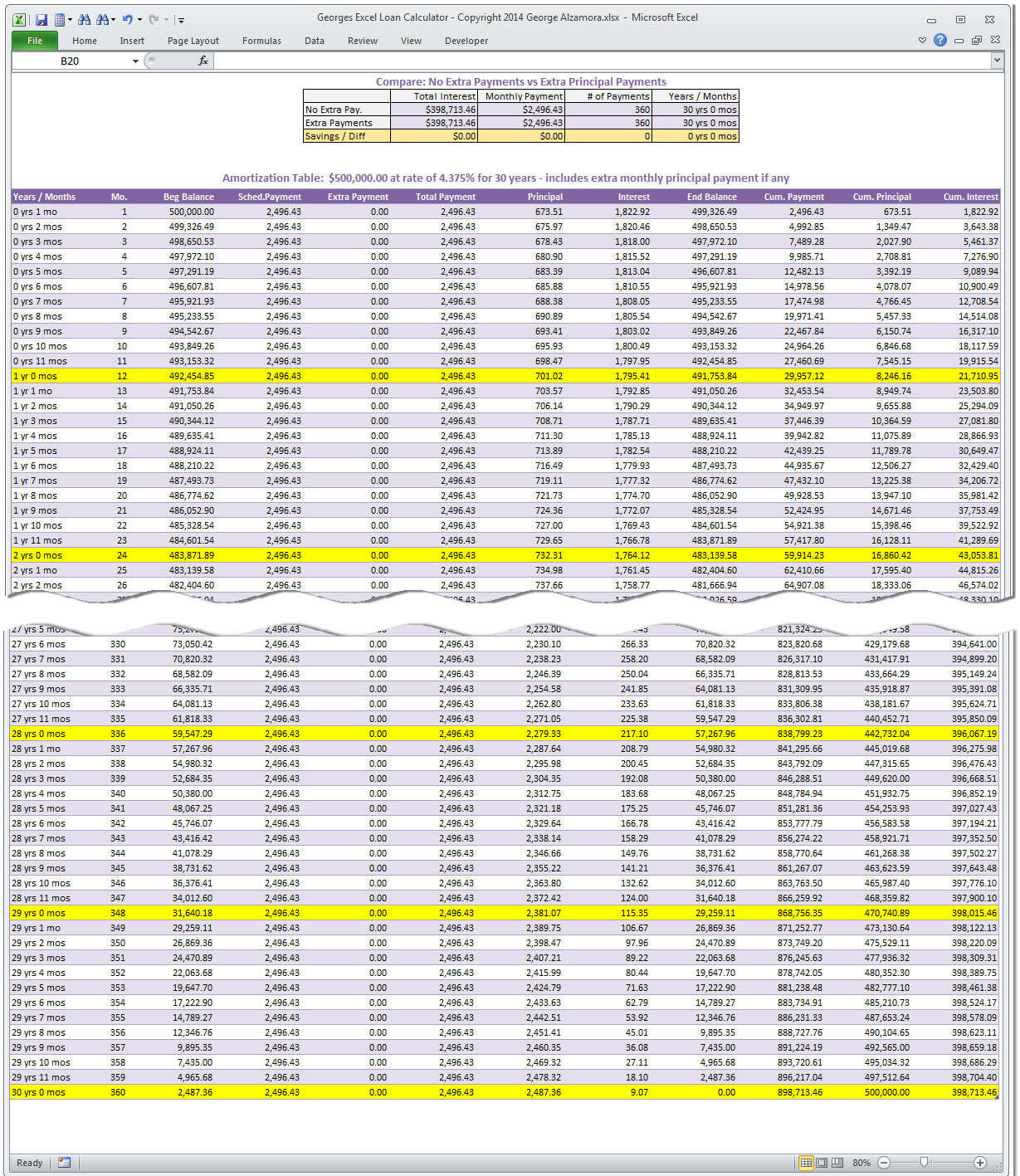

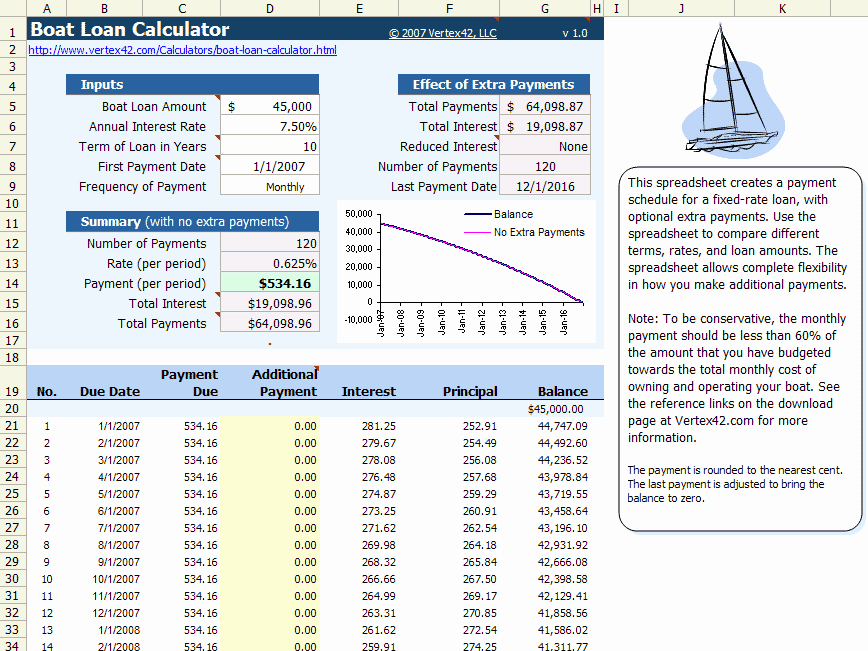

This information will include the principal amount from the home loan, the annual interest rate, additional repayment amount each month when additional repayments will start, and any lump sum payment to be made throughout the life of the loan. Your Mortgage’s Extra and Lump Sum Calculator will ask you to provide a few important pieces of information for it to perform its number-crunch.

How the extra and lump sum calculator works Different terms, fees or other loan amounts might result in a different comparison rate. Warning: this comparison rate is true only for this example and may not include all fees and charges. *The Comparison rate is based on a $150,000 loan over 25 years. Monthly repayments, once the base criteria are altered by the user, will be based on the selected products’ advertised rates and determined by the loan amount, repayment type, loan term and LVR as input by the user/you. All products will list the LVR with the product and rate which are clearly published on the product provider’s website. Some products will be marked as promoted, featured or sponsored and may appear prominently in the tables regardless of their attributes. However, the ‘Compare Home Loans’ table allows for calculations to be made on variables as selected and input by the user. In the meantime, for those wanting to find out how much additional payments can impact their home loan and determine its final amount - as well as the principal and interest rate fees that are included - Your Mortgage’s Extra and Lump Sum Calculator can be insightful on this front.Īll you need to do is have some information handy and the calculator will do the rest.Ĭompare interest rates from some of the most popular lenders in Australia:īase criteria of: a $400,000 loan amount, variable, fixed, principal and interest (P&I) home loans with an LVR (loan-to-value) ratio of at least 80%. Alternatively, you could discuss with a financial adviser, accountant, or mortgage broker to decide which repayment strategy will be best suited to you. With this in mind, it could be worth checking the terms and conditions attached to your mortgage before deciding whether making extra and lump sum payments will work in your favour. Most notably, lookout for a ‘break fee’, which is generally only charged if you pay down your fixed-rate (rather than a variable rate) home loan earlier than expected. Since the amount of interest is based on the principal, the lower this amount is, the lower the interest charges.ĭespite these benefits, it’s important to note the drawbacks of making extra payments. Think of it this way: extra repayments directly pay down the principal amount owing on your home loan (the amount of money you borrowed). Making extra and lump sum payments can significantly diminish the total amount you pay back on your mortgage, which could save you tens of thousands of dollars. The sooner you can contribute additional money along with your standard monthly repayments, the better.

The average home loan can span anywhere from 25 to 30 years - this is a big commitment! It’s also a long time to be making repayments and incurring interest, which is why reducing the life of your home loan is a helpful way to save money.Īn easy way to make your money work for you is to put it towards your mortgage in additional and lump-sum payments. Save on interest and reduce your loan term by making extra or lump sum payments

0 kommentar(er)

0 kommentar(er)